It can be more useful, especially for management decision-making concerning break-even analysis to derive the number of product units that must be sold to reach profitability. Direct labor costs are the wages and benefits paid to employees who are directly involved in the production of a product. These are individuals whose efforts can be directly attributed to a specific product’s manufacturing. Absorption costing is viewed as the cornerstone of cost accounting in manufacturing businesses and plays a pivotal role in financial decision-making and performance evaluation. This distinction should be implemented in order to construct a flexible budget. Moreover, due to the existence of fixed expenses, an increase in output volume usually results in a lower unit cost.

Practical Illustrations: Absorption Costing Examples and Solutions

- If 25 hours are spent on a job, then the absorption on the job will be of $0.2 x 25 hours (i.e., $5).

- Moreover, there is no concept of overhead overabsorption or under-absorption.

- Direct labor costs are the wages and benefits paid to employees who are directly involved in the production of a product.

- Assigning costs involves dividing the usage measure into the total costs in the cost pools to arrive at the allocation rate per unit of activity, and assigning overhead costs to produced goods based on this usage rate.

This ensures that the cost pertaining to a cost center must be absorbed as per the set norms. Suppose XYZ Manufacturing produces 2,000 units of Widget X in a month. Discover the top 5 best practices for successful accounting talent offshoring. Deskera Books will assist in inventory management, automate inventory tracking and their insights.

Everything to Run Your Business

Absorption costing is also often used for internal decision-making purposes, such as determining the selling price of a product or deciding whether to continue producing a particular product. In these cases, the company may use absorption costing to understand the full cost of producing the product and to determine whether the product is generating sufficient profits to justify its continued production. In contrast to the variable costing method, every expense is allocated to manufactured products, whether or not they are sold by the end of the period. Under generally accepted accounting principles (GAAP), U.S. companies may use absorption costing for external reporting, however variable costing is disallowed. Variable costing is a valuable management tool but it isn’t GAAP-compliant and it can’t be used for external reporting by public companies. A company may also have to use absorption costing which is GAAP-compliant if it uses variable costing.

Accurate Profitability Tracking

Through Deskera CRM, you can focus on contact and deal management, activity management, knowledge base management and tracking of communications to inventory management all in one platform with all the real-time updates. A drop in output, on the other hand, usually means a greater cost per unit. Therefore, cost comparison and control become harder as a result of this. Furthermore, Marketing, customer service, and R&D might be divided into different cost pools. As you spend money, you’ll eventually allocate costs to the cost pool that best describes them.

Moreover, there is no concept of overhead overabsorption or under-absorption. Product costs include all fixed production overheads as well as variable manufacturing expenses. Absorption costing (also known as traditional costing, full costing, or conventional costing) is a costing technique that accounts for all manufacturing costs (both fixed and variable) as production cost. It is then utilized to calculate the cost of products produced and inventories. Total machine hours are used to determine the overhead absorption rate in this method.

You need to allocate all of this variable overhead cost to the cost center that is directly involved. Calculating usage involves determining the amount of usage of whatever activity measure is used to assign overhead costs, such as machine hours or direct labor hours used. It also considers all direct costs (i.e. materials, labor, and expenses). The absorbed cost is a part of generally accepted accounting principles (GAAP), and is required when it comes to reporting your company’s financial statements to outside parties, including income tax reporting. Calculating absorbed costs is part of a broader accounting approach called absorption costing, also referred to as full costing or the full absorption method.

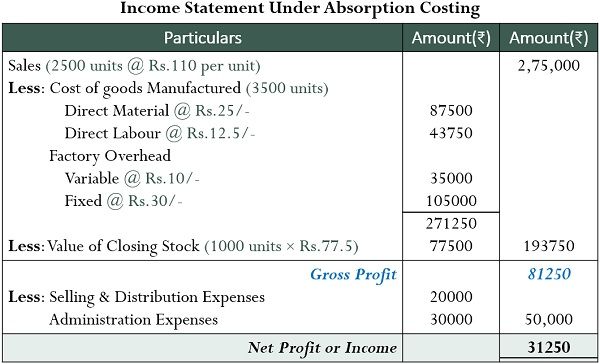

Knowing the full cost of producing each unit enables manufacturers to price their products. Absorption costing is a method of costing that includes all manufacturing costs, both fixed and variable, in the cost of a product. Absorption costing is used to determine the cost of goods sold and ending inventory balances on the income statement and balance sheet, respectively. It is also used to is interest on a home equity line of credit calculate the profit margin on each unit of product and to determine the selling price of the product. Variable costing doesn’t add fixed overhead costs into the price of a product so it can give a clearer picture of costs. These costs are hidden in inventory and don’t appear on the income statement when assigning these fixed costs to the cost of production, as absorption costing does.

These expenses must have some tie-in to the manufacturing process or site, though—they can’t include advertising or administrative costs at corporate HQ. Companies using the cash method may not have to recognize some of their expenses immediately with variable costing because they’re not tied to revenue recognition. Expenses incurred to ensure the quality of the products being manufactured, such as inspections and testing, are included in the absorption cost.

This results in fixed costs impacting COGS rather than flowing straight to the income statement. In summary, absorption costing provides a full assessment of production costs for inventory valuation, while variable costing aims to show contribution margin and provide internal reporting. Most companies use absorption costing for external financial reporting purposes. The absorption costing formula provides a reliable approach to allocate both variable and fixed manufacturing costs to units produced, yielding precise per unit costs.

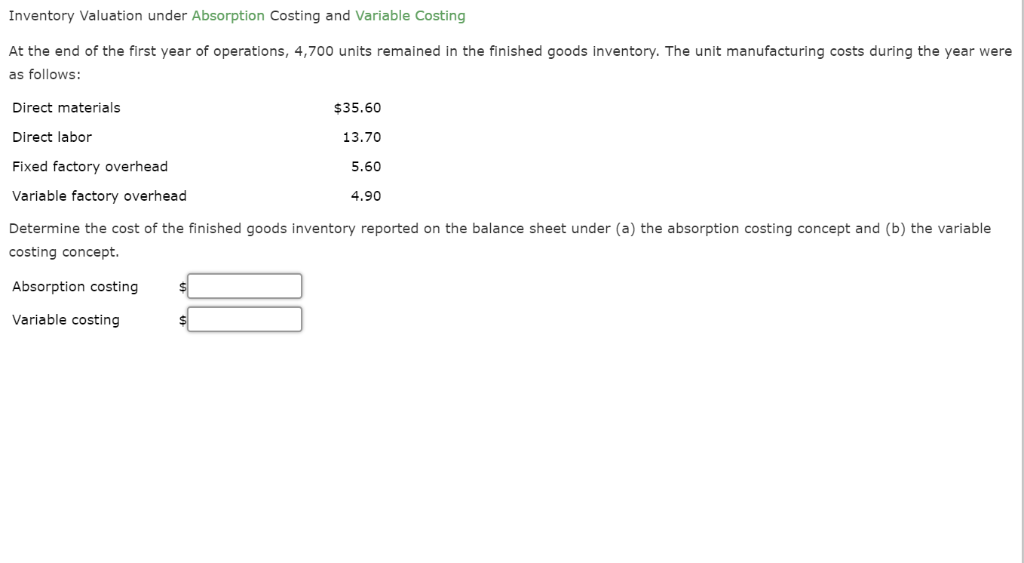

Absorption costing captures all manufacturing costs, including direct materials, direct labor, and both variable and fixed overhead, in the valuation of inventory. Absorption costing allocates all manufacturing costs, including fixed overhead costs, to the units produced. This differs from variable costing, which only allocates variable costs. Here are two examples showing how absorption costing is applied in practice. The key difference from variable costing is that fixed production costs are included in the inventory valuation and expense recognition under absorption costing. Careful COGS calculation as per GAAP standards is essential for accurate financial reporting.